SOFL

2x Daily Software Platform ETF

Investment Objective

The Fund seeks daily investment results, before fees and expenses, that correspond to two times (2x) the return of the AOT VettaFi Software Platform Index (the “Index”) for a single day.

The Fund does not seek to achieve its stated investment objective for a period of time different than a trading day.

The 2x Daily Software Platform ETF

Traders can use this fund as a vehicle to:

- Seek magnified gains of the Software Platform Index (will also magnify losses)

- Receive a target level of daily exposure to the Software Platform Index for less cash

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leveraged (2x) investment results, understand the risks associated with the use of leverage, and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. For periods longer than a single day, the Fund will lose money if the Index’s performance is flat, and it is possible that the Fund will lose money even if the level of the Index increases over a period longer than a single day. An investor could lose the full principal value of his/her investment within a single day.

The Investment Case for Software Platforms

Low Marginal Cost

Software platforms are scalable businesses that support high margins and revenue growth at scale with virtually no additional costs or the need for debt financing. Low incremental sales costs means more revenue can be used to innovate, build new products, and provide increased utility to customers, creating a sustainable competitive advantage.

AI and Innovation Tailwinds

Artificial intelligence and applications such as generative AI are creating new opportunities for software companies, as investor focus shifts from hardware infrastructure to software applications. AI has the potential to lower the cost of development and increase the rate of innovation, producing a unique investment opportunity.

Scalability

A Critical Advantage for Software Platforms. The marginal cost of traditional goods increases with production due to resource constraints, the marginal cost of digital goods trends to zero as production scales. This provides an important strategic advantage for software platform companies.

Fund Details

| Name | Value |

|---|---|

| Fund Name | 2x Daily Software Platform ETF |

| Fund Inception | 7/1/2023 |

| Ticker | SOFL |

| Primary Exchange | NYSE Arca |

| CUSIP | 45259A373 |

| Expense Ratio | 1.29% |

| 30 Day SEC Yield* As of 09/30/2025 | 2.49% |

*The 30-Day SEC Yield is calculated with a standardized formula mandated by the SEC. The formula is based on the maximum offering price per share and does not reflect waivers in effect.

Fund Data and Pricing

| Name | Value |

|---|---|

| Net Assets | $1.13m |

| NAV | $22.69 |

| Shares Outstanding | 50,000 |

| Premium/Discount Percentage | 0.16% |

| Closing Price | $22.73 |

| Median 30 Day Spread* | 0.58% |

| Name |

|---|

| 10/03/2025 |

*30-Day Median Spread is a calculation of Fund’s median bid-ask spread, expressed as a percentage rounded to the nearest hundredth, computed by: identifying the Fund’s national best bid and national best offer as of the end of each 10 second interval during each trading day of the last 30 calendar days; dividing the difference between each such bid and offer by the midpoint of the national best bid and national best offer; and identifying the median of those values.

Performance

| Fund Name | Fund Ticker | 1 Month | 3 Month | 6 Month | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception (Cumulative) | Since Inception (Annualized) | Date |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2x Daily Software Platform ETF | SOFL MKT | 8.97 | - | - | - | - | - | - | - | 13.26 | - | 09/30/2025 |

| 2x Daily Software Platform ETF | SOFL NAV | 8.83 | - | - | - | - | - | - | - | 13.12 | - | 09/30/2025 |

| Fund Name | Fund Ticker | 1 Month | 3 Month | 6 Month | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception (Cumulative) | Since Inception (Annualized) | Date |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2x Daily Software Platform ETF | SOFL MKT | 8.97 | - | - | - | - | - | - | - | 13.26 | - | 09/30/2025 |

| 2x Daily Software Platform ETF | SOFL NAV | 8.83 | - | - | - | - | - | - | - | 13.12 | - | 09/30/2025 |

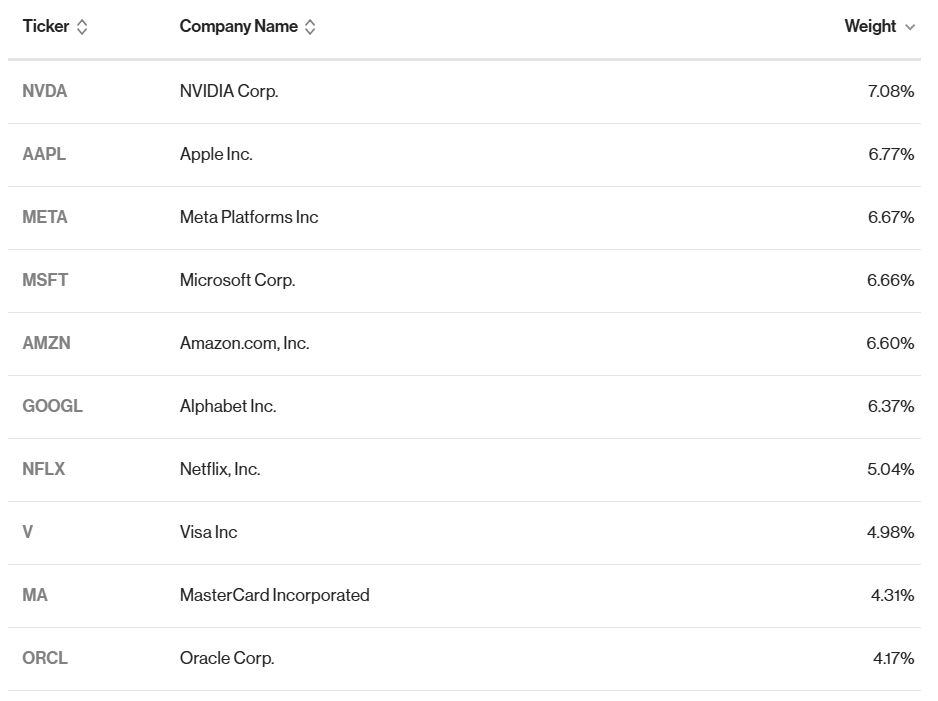

Top 10 Index Holdings

Top 10 Fund Holdings

| Name |

|---|

| 10/06/2025 |

| Date | Account | StockTicker | CUSIP | Name | Shares | Price | Market Value | Weightings | NetAssets | SharesOutstanding | CreationUnits |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 10/06/2025 | SOFL | SOFTT INDEX 8/1/26-L-MAR | SOFTT INDEX 8/1/26-L-MAR | SOFTT INDEX MAREX INC - L- MAREX | 320 | 7098.51 | 2271523.2 | 200.19% | 1134690 | 50000 | 5 |

| 10/06/2025 | SOFL | 912797RE9 | 912797RE9 | United States Treasury Bill 10/28/2025 | 945000 | 99.7525 | 942661.13 | 83.08% | 1134690 | 50000 | 5 |

| 10/06/2025 | SOFL | FGXXX | 31846V336 | First American Government Obligations Fund 12/01/2031 | 42565 | 100 | 42564.92 | 3.75% | 1134690 | 50000 | 5 |

| 10/06/2025 | SOFL | Cash&Other | Cash&Other | Cash & Other | -2122514 | 1 | -2122513.52 | -187.06% | 1134690 | 50000 | 5 |

About The Index

The Index is a rules-based index designed to track the performance of the top companies that rely on, contribute to, or create “Software Platforms” (described below) that enable the core functions and delivery of services.

The Index generally consists of the 50 highest ranked software driven enterprises based on a combination of quality factors scores and market presence scores.

“Software Platforms” are comprehensive software systems that provide the core infrastructure needed to build, manage, and operate digital applications and services. These platforms form the technological foundation of companies that depend heavily on software. For these companies, software is essential to delivering products, managing operations, and executing business strategies. Software platforms are typically designed to be scalable and adaptable, supporting a wide range of users, clients, and developers within broader digital ecosystems.

To learn more about the index and view index holdings, please visit https://www.vettafi.com/indexing/index/soft

Portfolio Manager

John is the founder and CEO of AOT Invest. He serves as the portfolio manager to the SOFL ETF and the AOTG ETF. John’s specialized investment strategies target businesses whose products or services have low marginal cost attributes and high growth potential. Before AOT Invest, he worked as a market maker and trader in Chicago and studied Economics at Northwestern University and the University of Oxford.